- Turbo tax free file extension 2016 how to#

- Turbo tax free file extension 2016 windows 10#

- Turbo tax free file extension 2016 software#

- Turbo tax free file extension 2016 password#

tax2016 file stores tax return financial data for year 2016 prepared in TurboTax program.

Turbo tax free file extension 2016 software#

Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment) File extension tax2016 is related to the TurboTax - a tax preparation and financial software for Microsoft Windows and macOS (OS X) operating systems. Form 2350, Application for Extension of Time to File U.S.Form 1138, Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback.Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.Serving in a combat zone or a qualified hazardous duty area.Form 4868, Application for Automatic Extension of Time To File U.S.Common reasons to ask for a free tax extension is.

Turbo tax free file extension 2016 how to#

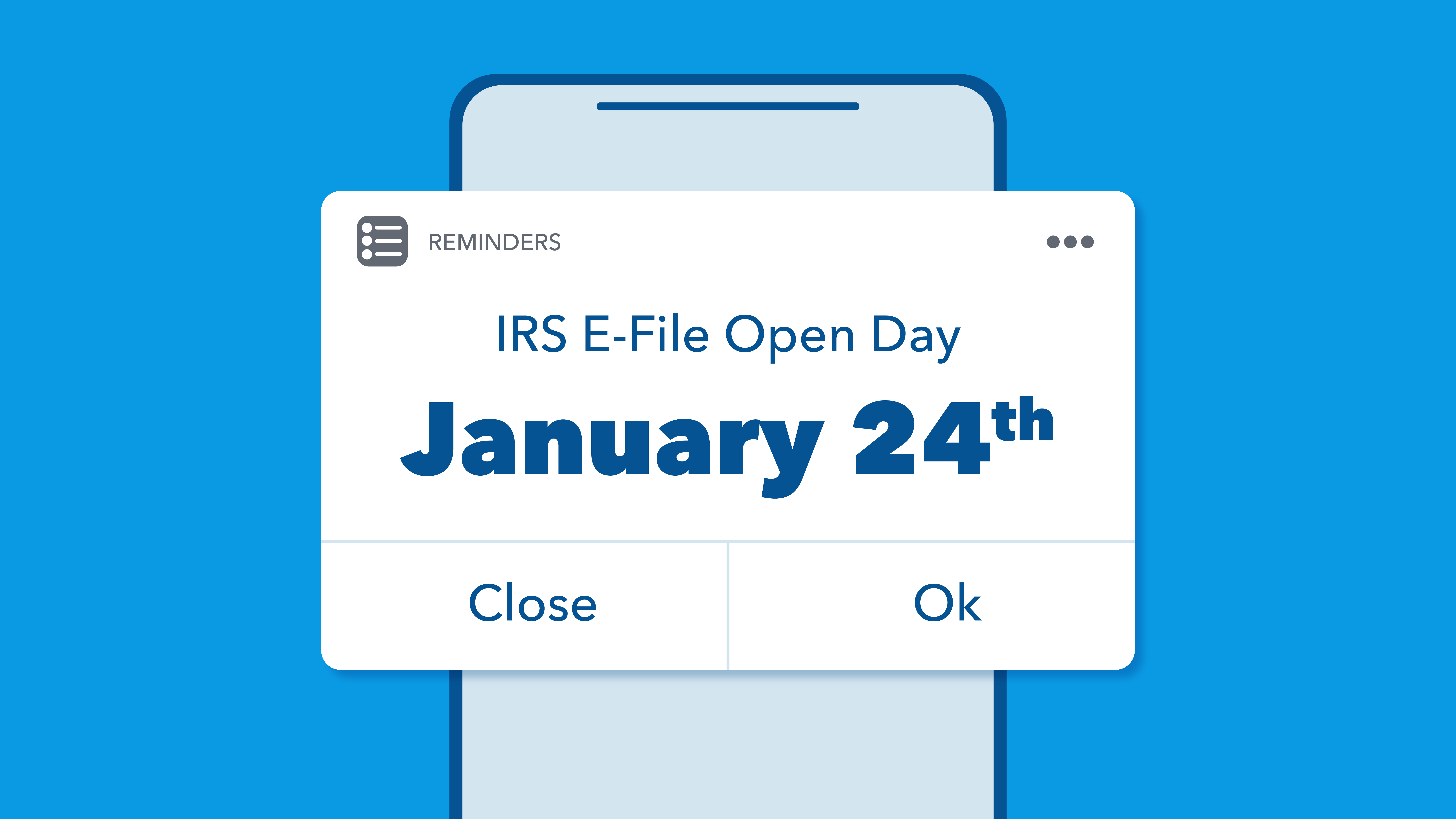

Extension Forms by Filing Status Individuals This guide will show you how to file a 2016 tax extension using IRS Form 4868 right from your iPhone. This way you won’t have to file a separate extension form and you will receive a confirmation number for your records. You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit or debit card. To get the extension, you must estimate your tax liability on this form and should also pay any amount due.Filing this form gives you until October 15 to file a return.Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. To file 2014, 2015 or 2016 you will need to use the Desktop product located here: https://. You must file your extension request no later than the regular due date of your return. 8 hours ago How to file my 2012 taxes on Turbo tax for free.

Turbo tax free file extension 2016 password#

TAX2016 files may be encrypted if saved with password protection since they store sensitive personal and financial. It may also include one or more state forms for the 2016 tax year. It contains a users personal information and federal IRS tax forms.

Turbo tax free file extension 2016 windows 10#

Our data shows that TAX2016 files are frequently utilized by PC users in United States and popular on the Windows 10 platform. IRS talks handling child tax credit, stimulus checks on 2021 taxes Who can use Turbo Tax’s free services? created the TurboTax 2016 Tax Return (TAX2016) file for the Intuit TurboTax software series.

0 kommentar(er)

0 kommentar(er)